Lets go back in time.

This seminar series will contain four modules, starting with the past and finishing with the future of property. The body modules will contain leaseholds, as well as freeholds. So, check out the links below for more information.

Quick Guide

Let’s dive in history of energy in legal English.

What is a freehold estate?

Let’s talk about the different types of freehold estates.

In real estate law, a freehold estate refers to the ownership of land or property for an indefinite period of time.

The word «fee» originates from the Old English word «feoh,» which means cattle, goods, or money.

Fee simple ownership grants the owner absolute and unrestricted rights over the property. The word «fee» originates from the Old English word «feoh,» which means cattle, goods, or money. In this context, it signifies absolute ownership without any limitations or conditions.

Main Types

These are the 3 main points to focus on.

Fee Simple Absolute: This is the most complete form of ownership, granting the owner complete and unconditional control over the property. The owner has the right to possess, use, alter, sell, or transfer the property during their lifetime and can also pass it on to their heirs upon their death.

Life Estate: A life estate grants ownership rights to an individual for the duration of their lifetime. The owner, known as the life tenant, has the right to use and enjoy the property during their lifetime, but ownership reverts to another party, known as the remainderman, upon the life tenant’s death.

Fee Tail: A fee tail estate restricts the ownership of property to a specific bloodline or lineage. The property is inherited by the owner’s direct descendants and cannot be sold, transferred, or devised to anyone outside the designated bloodline.

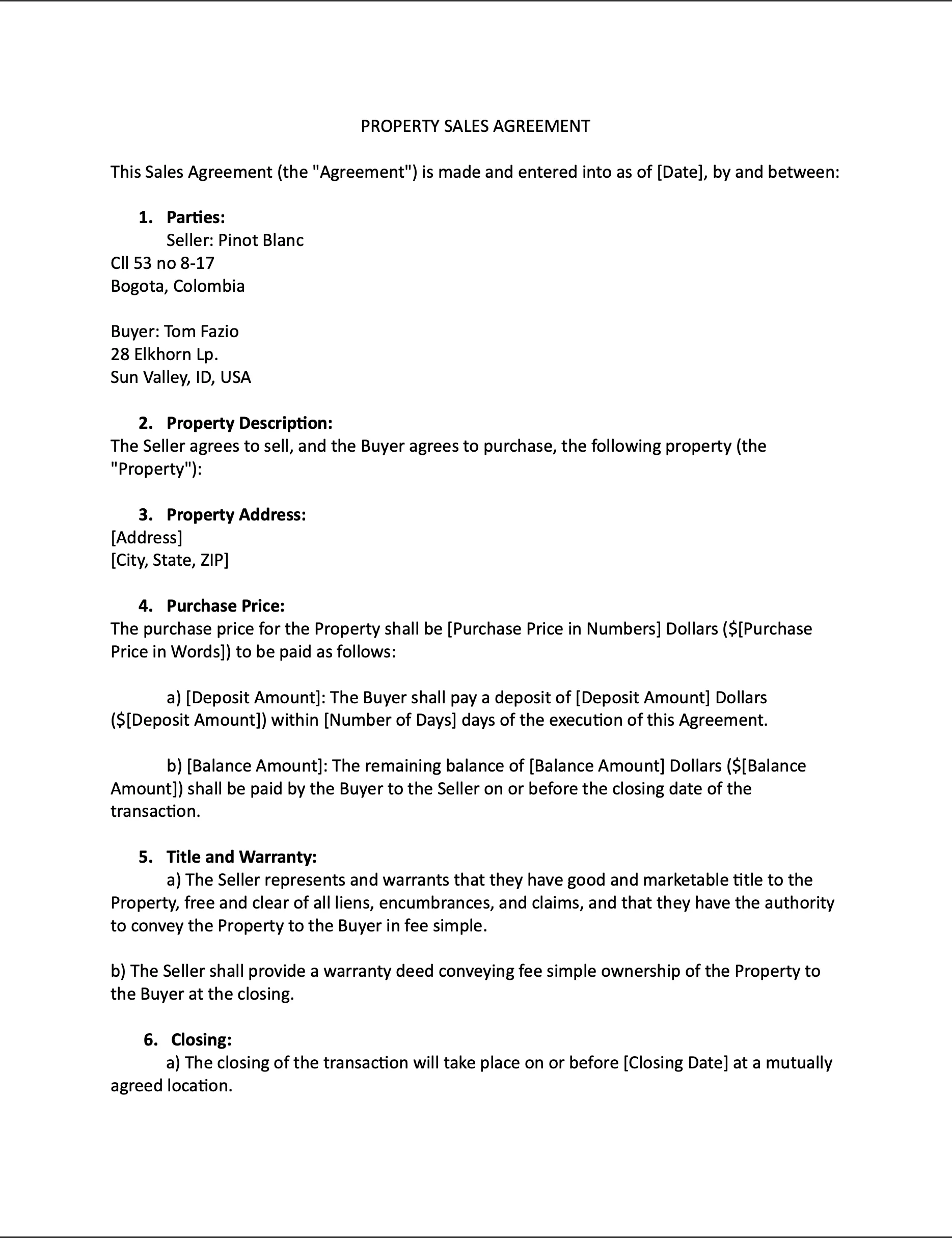

The Purchase Agreement

Warranty of Title: The Seller represents and warrants that they have good and marketable title to the Property, free and clear of all liens, encumbrances, and claims, and that they have the authority to convey the Property to the Buyer in fee simple.

Correct use: Convey the Property to the Buyer in fee simple.

Representations and Warranties: The Lessor represents and warrants that they are the legal owner of the premises in fee simple, and have the full power and authority to lease the Property to the Lessee.

Correct use: … are the legal owner of the premises in fee simple.

Indemnification: The Seller agrees to indemnify and hold harmless the Buyer from any claims, demands, or actions related to the Seller’s lack of fee simple interest in the Property.

Correct use: … the Seller’s lack of fee simple interest in the Property.

Termination or Default: In the event of default by the Buyer, the Seller shall have the right to terminate this Agreement and reclaim fee simple interest in the Property.

Correct use: to terminate this Agreement and reclaim fee simple interest in the Property.

Use and Restrictions: The Property shall be used solely for residential purposes and the Buyer agrees to abide by all applicable zoning regulations and any covenants, conditions, and restrictions that encumber the Property in fee simple.

Correct use: … restrictions that encumber the Property in fee simple.

Types of Agreements

Standard Purchase Agreement: This is the most common type of purchase agreement used in real estate transactions. It outlines the terms and conditions of the sale, including the purchase price, financing details, contingencies, closing date, and any other relevant provisions. It is typically a comprehensive and legally binding document that governs the transaction.

As-Is Purchase Agreement: An as-is purchase agreement is used when the property is being sold in its current condition, without any warranties or guarantees from the seller regarding its condition. The buyer accepts the property in its current state, assuming any risks or repairs that may be needed after the purchase.

Contingent Purchase Agreement: A contingent purchase agreement includes specific conditions or contingencies that must be met for the sale to proceed. These contingencies may include satisfactory home inspections, appraisal results, or the buyer securing financing. If any of the contingencies are not met, the buyer may have the right to terminate the agreement without any penalty.

Lease-Purchase Agreement: A lease-purchase agreement combines elements of a lease and a purchase agreement. It allows a tenant to lease the property for a specified period with an option to purchase the property at a later date. The agreement typically outlines the terms of the lease, the purchase price, and any rent credits that may be applied towards the purchase.

What is Escrow?

Opening Escrow: Once the purchase agreement is signed, an escrow account is opened with an escrow agent. The buyer deposits the earnest money or down payment into the escrow account, which serves as a form of good faith deposit.

Document and Fund Collection: The escrow agent collects all necessary documents, such as the deed, title insurance, and financing documents. The agent also verifies the accuracy and completeness of these documents.

Fulfillment of Conditions: The escrow agent ensures that all conditions specified in the purchase agreement are fulfilled. This may include inspections, repairs, and other contingencies.

Distribution of Funds: Once all conditions are met, the escrow agent disburses the funds in the escrow account according to the instructions outlined in the purchase agreement. This includes paying off existing mortgages or liens, fees, and commissions.

Title Transfer: After the funds are distributed, the escrow agent facilitates the transfer of the property’s title from the seller to the buyer. The deed is recorded with the appropriate governmental authority, completing the transfer of ownership.

By using an escrow arrangement, both the buyer and seller can have confidence that the transaction is secure and proceeds according to the agreed-upon terms. The escrow agent ensures that the funds and documents are handled in a transparent and impartial manner, minimizing the risk for both parties.

Forms of Appraisals

Property appraisal value is typically calculated by professional appraisers who consider several factors and methods. While the specific approach may vary based on the property type and market conditions, here are some common methods used in property appraisal:

Sales Comparison Approach: This method involves comparing the subject property to recently sold similar properties (comparables) in the same area. Appraisers consider factors such as size, location, condition, amenities, and recent sale prices of comparable properties to estimate the value of the subject property.

Cost Approach: This approach estimates the value of the property by determining the cost to replace or reproduce it. Appraisers consider factors such as the cost of land, construction materials, labor, and any depreciation or obsolescence. This method is often used for new or unique properties where there may be limited comparable sales data available.

Income Approach: This method is primarily used for income-generating properties such as rental properties or commercial buildings. It involves estimating the property’s value based on its income potential and the prevailing market capitalization rates. Appraisers analyze rental income, expenses, vacancy rates, and market trends to calculate the property’s value.

Cost per Square Foot: In some cases, appraisers may use the cost per square foot method to estimate the value of residential properties. They calculate the value by multiplying the property’s total square footage by the average cost per square foot in the local market.

Tax Evaluations

Property evaluations for tax purposes are typically conducted by tax assessors or appraisal districts. The process may vary depending on the jurisdiction, but here is a general overview of how property evaluations for tax purposes are conducted:

Valuation Calculation: Assessors apply the chosen assessment method to calculate the assessed value of the property. This value serves as the basis for property tax calculation.

Data Collection: Tax assessors gather information about the property, including its physical characteristics, size, features, and any improvements or additions. They may rely on public records, previous assessments, property visits, and other sources to collect accurate data.

Property Classification: The property is classified based on its designated use, such as residential, commercial, industrial, or agricultural. Different classifications may have varying assessment methods or tax rates.

Assessment Methodology: Tax assessors use various methods to determine the assessed value of the property. Common methods include the sales comparison approach, cost approach, or income approach, similar to those used in appraisals. The specific method chosen depends on factors such as property type, market conditions, and available data.

Market Analysis: Assessors analyze recent sales data and market trends to understand property values in the area. They compare the subject property to similar properties (comparables) to assess its value.

Property Management: For landlords, long-term leases can reduce the time and effort required for property management. With stable and long-lasting tenants, the need for marketing, screening, and executing new lease agreements is less frequent.

Notice and Appeals

Notice of Assessment: Once the property is evaluated, the tax assessor sends a notice of assessment to the property owner. The notice includes the assessed value, any exemptions or deductions, and instructions for appealing the assessment if the owner disagrees with it.

Appeals Process: Property owners have the right to appeal the assessed value if they believe it is inaccurate or unfair. The specific procedures and deadlines for appeals vary by jurisdiction. Owners can present evidence, such as recent sales data or property appraisals, to support their case during the appeals process.

As Is

«As is» in real property refers to the condition of a property at the time of sale. When a property is sold «as is,» it means that the seller is offering the property in its current condition without making any warranties or guarantees regarding its condition or making any promises to perform repairs or improvements.

«As is» in real property refers to the condition of a property at the time of sale. When a property is sold «as is,» it means that the seller is offering the property in its current condition without making any warranties or guarantees regarding its condition or making any promises to perform repairs or improvements.

The phrase «as is» indicates that the seller is not responsible for any defects, damages, or issues that may exist in the property. It places the responsibility on the buyer to thoroughly inspect the property and accept it in its current state.

By selling a property «as is,» the seller is essentially notifying the buyer that they will not be responsible for any repairs, defects, or problems that may be discovered after the sale. This includes both visible and hidden issues that the buyer could have discovered through a reasonable inspection.

It’s important for buyers considering an «as is» property to conduct thorough due diligence, including inspections, to identify any potential problems or concerns. Buyers should also be aware that financing options may be limited for properties sold «as is» as lenders may have specific requirements regarding property condition.

However, it’s worth noting that even in an «as is» sale, sellers must still adhere to disclosure requirements, which may vary depending on local laws and regulations. Sellers may still be obligated to disclose known material defects or issues that could affect the value or desirability of the property.

General Vocabulary

Fee Simple: The highest and most complete form of ownership of real property, granting the owner full and absolute rights over the property.

Life Estate: An estate in which a person, known as the life tenant, has the right to use and enjoy a property during their lifetime. Ownership of the property reverts to another party, known as the remainderman, upon the life tenant’s death.

Remainderman: The person or entity who holds the future interest in a property during a life estate. They will take ownership of the property after the life estate ends.

Reversionary Interest: The interest or right retained by a grantor or their successors in interest when transferring a property, which allows them to regain ownership of the property upon the occurrence of a specified event or at the end of a particular estate.

Fee Tail: An estate that restricts the ownership of property to a specific bloodline or lineage, allowing it to be inherited only by direct descendants and not freely sold or transferred.

Fee Simple Defeasible: An estate that is subject to certain conditions or limitations, which, if violated, can cause the property to revert to the original grantor or a specified third party.

Determinable Condition: A condition attached to a fee simple defeasible estate that automatically terminates the estate if a specific event or condition occurs.

Tenancy in Common: A form of co-ownership in which each owner holds an undivided interest in the property, with no right of survivorship. Each owner has the right to transfer or sell their interest independently.

Joint Tenancy: A form of co-ownership in which each owner has an equal undivided interest in the property, with the right of survivorship. If one joint tenant passes away, their interest automatically transfers to the surviving joint tenants.

Right of Survivorship: The right of a co-owner in a joint tenancy or tenancy by the entirety to automatically acquire the interest of a deceased co-owner, without the need for probate.