Lets go back in time.

This seminar series will contain four modules, starting with the past and finishing with the future of property. The body modules will contain leaseholds, as well as freeholds. So, check out the links below for more information.

Quick Guide

Let’s dive in history of energy in legal English.

Let’s dive in history of real property in legal English.

Real Property Timeline

Let’s dive in history of real property in legal English.

1000s: Feudal System – Feudalism establishes a hierarchical system of land ownership, with lords granting land to vassals in exchange for loyalty and services.

17th Century: Statute of Frauds – The Statute of Frauds is enacted in England, requiring certain contracts, including real estate contracts, to be in writing to be enforceable.

1850s: Homestead Act (USA) – The Homestead Act encourages settlement of the American West by granting 160 acres of public land to individuals who improved and resided on the property.

1875: Metes and Bounds Survey System – The Metes and Bounds survey system is established in the United States to accurately define and describe the boundaries of land parcels.

1933: National Housing Act (USA) – The National Housing Act creates the Federal Housing Administration (FHA), which facilitates mortgage insurance and promotes homeownership.

1968: Fair Housing Act (USA) – The Fair Housing Act prohibits discrimination in housing based on race, color, religion, sex, or national origin in the United States.

1978: Proposition 13 (California, USA) – Proposition 13 limits property tax increases in California, leading to the widespread adoption of property tax limitation measures in other jurisdictions.

1997: Kyoto Protocol – The Kyoto Protocol recognizes the role of real property in environmental conservation and sets international targets for reducing greenhouse gas emissions.

2008: Global Financial Crisis – The financial crisis has a profound impact on real estate markets worldwide, leading to a housing market crash, foreclosure crisis, and increased regulation of the financial sector.

2019: Blockchain and Smart Contracts – The adoption of blockchain technology and smart contracts offers potential for increased transparency, efficiency, and security in real estate transactions and ownership records.

Real Estate vs Real Property

The terms «real estate» and «real property» are often used interchangeably, but they have slightly different meanings and implications:

In essence, real estate refers to the tangible assets, such as land and buildings, while real property includes the legal rights, interests, and ownership associated with those assets. Real estate is a physical concept, whereas real property is a legal concept that recognizes the rights and interests that individuals or entities have in real estate.

It’s important to note that the distinction between real estate and real property may vary in different jurisdictions, and the terms are often used interchangeably in casual conversation or general discussions.

Real Estate: Real estate refers to the physical property, including land and any structures or improvements attached to it. It encompasses both the land and the buildings or structures on that land, such as houses, commercial buildings, and other types of built property.

Real Property: Real property is a legal term that encompasses the rights, interests, and ownership associated with real estate. It refers to the bundle of legal rights and interests an individual or entity holds in the real estate.

What is an estate?

In the context of real property, an estate refers to the legal interest or right that an individual or entity holds in a piece of real estate. It represents the degree, nature, and duration of the ownership or interest in the property.

An estate in real property is a legal concept that defines the specific rights, interests, and duration of ownership that an individual or entity possesses in relation to a particular piece of land or property. It encompasses the bundle of legal rights and responsibilities associated with the property, dictating the extent of control, use, and transferability that the owner or holder of the estate has over the property.

The concept of an estate includes various types and classifications, such as freehold estates and leasehold estates. Freehold estates, also known as fee simple estates, grant the owner indefinite and absolute ownership rights, allowing them to possess, use, transfer, and enjoy the property without time limitations. Leasehold estates, on the other hand, represent a temporary interest in the property, typically acquired through a lease agreement, where the tenant or lessee has the right to possess and use the property for a specific period, subject to the terms and conditions of the lease.

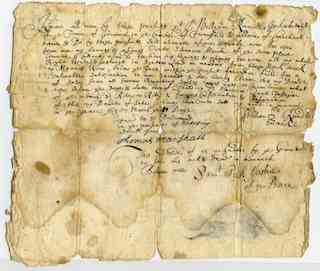

The estate in real property is typically documented through legal instruments, such as deeds, leases, or contracts, which specify the nature of the estate, its duration, and any limitations or conditions attached to it. These instruments provide evidence of ownership or interest, establishing the rights and obligations of the owner or holder of the estate, as well as any encumbrances or restrictions that may exist on the property.

The estate in real property is subject to applicable laws, regulations, and local jurisdictional requirements, which govern the transferability, encumbrances, and use of the property. It is important for individuals or entities involved in real estate transactions to understand the specific estate rights and obligations associated with a particular property to ensure compliance with legal requirements and to protect their interests in the real property.

In simple terms, an estate in real property refers to the legal rights and interests that someone has in a piece of land or property.

Freehold vs leasehold estates

Freehold Estate: A freehold estate refers to ownership of real property where the owner has indefinite or unlimited ownership rights. The owner, known as the freeholder or fee simple owner, has full control over the property and can possess, use, transfer, and enjoy it without time restrictions. Freehold estates can last indefinitely and can be passed down through inheritance. The freeholder has the highest form of property ownership and the most comprehensive bundle of rights associated with the property.

Leasehold Estate: A leasehold estate, also known as a lease, refers to a temporary or limited form of property ownership. In a leasehold arrangement, the owner of the property, known as the landlord or lessor, grants the right to possess and use the property to another party, known as the tenant or lessee, for a specified period of time. The tenant has exclusive possession and use of the property during the lease term but does not have ownership rights. The lease agreement outlines the terms, conditions, and duration of the lease, including the payment of rent.

Renewal and Termination: Freehold estates do not require renewal or termination, as ownership is ongoing. Leasehold estates have a predetermined lease term and typically require negotiation for lease renewal or termination at the end of the lease term.

Investment Value: Freehold estates generally have higher investment value and long-term equity-building potential. Leasehold estates, on the other hand, provide temporary use rights and do not offer the same level of long-term ownership benefits.

Main Differences

Duration: Freehold estates have an indefinite duration, while leasehold estates have a specific lease term, which can vary from months to decades.

Ownership Rights: Freehold estate owners have the highest form of ownership rights, including the right to possess, use, transfer, and enjoy the property without time limitations. Leasehold estate tenants have temporary possession rights and must comply with the terms of the lease agreement.

Responsibilities: Freehold estate owners are responsible for property maintenance, repairs, and costs. In leasehold estates, the landlord often retains responsibility for structural repairs and maintenance, while tenants are responsible for maintaining the leased premises during their occupancy.

General Vocabulary

Fee Simple: Absolute ownership of a property, with the most extensive bundle of rights.

Condominium: A type of property ownership where individuals own individual units within a larger building or complex.

Homeowners Association (HOA): An organization that manages and enforces rules for a residential community or condominium complex.

Easement: A right to use or access someone else’s property for a specific purpose, such as a right-of-way for utilities.

Lease: A contractual agreement between a landlord (lessor) and tenant (lessee) granting the tenant the right to use and occupy a property for a specific period.

Title: The legal ownership of a property.

Deed: A legal document that transfers ownership of a property from one party to another.

Fair Market Value: The price at which a property would sell between a willing buyer and a willing seller in an open market.

Real Estate Owned (REO): A property owned by a lender, typically a bank, as a result of a foreclosure.

Survey: A detailed measurement and mapping of a property’s boundaries, structures, and features.

Depreciation: A decrease in the value of a property or asset over time due to wear and tear or obsolescence.

Capitalization Rate (Cap Rate): The rate of return on an investment property based on the property’s net operating income (NOI).

Amortization: The gradual repayment of a loan through regular installments over time.

Section 1031 Exchange: A tax-deferred exchange of like-kind properties that allows investors to defer capital gains taxes.

Encumbrance: A claim or liability on a property, such as a mortgage, lien, or easement.

Appraisal: An estimate of the value of a property, conducted by a qualified appraiser.

Zoning: The division of land into different zones or districts, with specific regulations and permitted land uses.

Lien: A legal claim on a property as security for the payment of a debt.

Right of Way: A legal right to pass through or use another person’s property for a designated purpose.

Conveyance: The transfer of property from one party to another.

Assessment: The valuation of a property for taxation purposes.

Real Estate Investment Trust (REIT): A company that owns, operates, or finances income-generating real estate.

Marketable Title: A title that is free from defects or encumbrances, allowing for a smooth transfer of ownership.

Escrow: A process where a neutral third party holds funds or documents until the completion of a real estate transaction.

Mortgage: A loan secured by a property, where the property serves as collateral for the loan.

Deed vs Title

Property Deed: A property deed is a legal document that serves as evidence of ownership and transfers ownership of a property from one party to another. It is a written instrument that outlines the details of the property, identifies the buyer (grantee) and seller (grantor), and includes a legal description of the property. A property deed is typically signed, notarized, and recorded in the appropriate public records office to make the transfer of ownership official. Deeds come in various types, such as warranty deeds, quitclaim deeds, and special warranty deeds, each offering different levels of protection and guarantees to the grantee.

Title: Title, on the other hand, refers to the legal right of ownership and interest in a property. It represents the bundle of rights and privileges that come with property ownership. When someone has «title» to a property, they have legal ownership and can exercise various rights, such as possession, use, transfer, and exclusion of others from the property. The title is established by the chain of ownership, often traced through recorded deeds, and is recognized and protected by the legal system. A title can be held by an individual, a corporation, or another legal entity.

How is property measured?

Real property is typically measured using two primary dimensions: area and volume. The specific measurement method depends on the type of property being assessed. Here are the common measurement techniques for different types of real property:

Land: Land measurement is typically conducted in terms of area. The most commonly used units for land measurement include acres, and hectares. Surveying techniques are employed to determine the boundaries and size of a piece of land accurately.

The conversion between acres and hectares is as follows:

1 acre = 0.4047 hectares

1 hectare = 2.4711 acres

For example, if you have 5 acres, the equivalent in hectares would be:

5 acres x 0.4047 hectares/acre = 2.0235 hectares

To convert hectares to acres, you can multiply the number of hectares by 2.4711. For example, if you have 10 hectares, the equivalent in acres would be:

10 hectares x 2.4711 acres/hectare = 24.711 acres

These conversion factors allow you to convert between acres and hectares, which are commonly used units for measuring land area.

Residential Properties: Residential properties, such as houses and apartments, are measured in terms of the floor area. The floor area is the total area within the perimeter walls, excluding outdoor spaces like gardens or balconies. Residential properties are often measured in square feet or square meters.

-

Square Foot: The abbreviation for square foot is «sq ft» or «ft²».

-

Square Meter: The abbreviation for square meter is «sq m» or «m²».

Commercial Properties: Commercial properties, such as offices, retail spaces, and industrial buildings, are also measured in terms of floor area. However, the measurement may differ depending on the purpose of the property. For instance, offices are typically measured in rentable square feet (RSF) or square meters, while industrial properties might use measurements like total floor area or gross leasable area (GLA).

rentable square feet (RSF)

rentable square meters (RSM)

total floor area (TFA)

gross leasable area (GLA)

Multi-Unit Buildings: When measuring multi-unit buildings, such as apartment complexes or condominiums, the individual units’ floor areas are often combined to calculate the total floor area. This measurement is important for determining the total living space and the potential rental or sale value of the property.

Volume Measurement: In some cases, real property measurement may also involve volume, especially in industrial or warehouse settings where storage capacity is crucial. Volume is typically measured in cubic feet or cubic meters and helps determine the usable space for storing goods or materials.

Commercial Land: When measuring commercial land for development purposes, the total area is usually considered. This includes not only the land’s footprint but also factors like setback requirements, parking areas, and open spaces.

Real Property Numbers

Real Estate Market Size: The global real estate market was valued at approximately $3.4 trillion in 2020.

Property Taxes: Property taxes are an important source of revenue for governments. In the United States, property tax revenue amounted to over $600 billion in 2020.

Homeownership Rate: As of 2021, the global homeownership rate was around 54%, varying significantly across countries.

Real Estate Investment Trusts (REITs): REITs provide investors with an opportunity to invest in real estate through publicly traded securities. As of 2021, the global market capitalization of REITs was over $2 trillion.